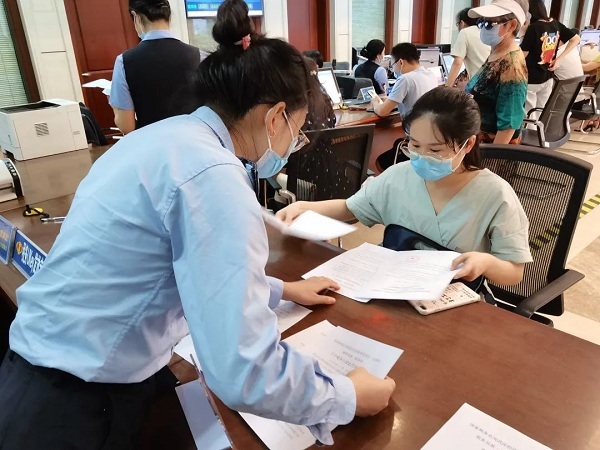

Staff members from WEDZ's tax bureau check out tax applications. [Photo provided to en.whkfq.gov.cn]

The "no penalty for first violation" smart tax procedures made by the tax administration division of the Wuhan Economic & Technological Development Zone (WEDZ) were recently selected as one of the 10 typical cases for business environment reforms in Central China's Hubei province.

The new tax policy has been widely lauded by local enterprises. "The officials exempted us from fines, and the credit rating of the company remained unaffected (a credit rating was needed because at that time the company was applying for a loan)," said a staff member surnamed Duan, whose company failed to file for tax returns within the designated time due to personnel changes.

Previously, the company needed to accept an administrative penalty and apply to file for the tax returns. Thanks to the new policy, they did not have to pay the fines, and they have successfully gained a loan from the bank.

Last year, the zone's tax bureau became a pilot zone for the "no penalty for first violation" smart tax procedures in Hubei. Through a series of optimized processes, the materials needed to handle tax affairs were simplified, and the tax handling period was also shortened.

The online platform can now automatically select applicants who meet the conditions for the "no penalty for first violation" procedures, and so far, a total of 2,799 market entities have benefited from this tax policy. It has also saved about 1,800 hours for all parties involved, and alleviated operational costs for enterprises.